The starting point

Having spent a number of years in the wind industry; where it went from a few wind turbines in a farmers field, to utility scale investments, it is valuable to explore why this came about and how it successfully became a core part of the energy supply industry. The starting point for all of this is the consumer and their expectations; which are for a reliable, economic source of power that increasingly meets the higher environmental standards required now and into the future.

Connecting wind to the consumer

It is useful to draw a quick diagram showing the key elements of how wind reaches the consumer. To many people it is simply connecting a wind turbine to the power supply network, in a way that is correct, however, to meet the reliability and economic tests requires considerably more to be considered.

The diagram above shows what is necessary to utilise wind power, the requirement to provide reliability means a back up supply is necessary, without it then the lights will go out. The other observation is that the back up supply has to be equal to the wind capacity available to a very large degree as when the wind stops, the demand still has to be fulfilled. This clearly necessitates more capacity has to be available when the supplier to the consumer is going to use wind as a potential power source. The key advantage of wind is that the fuel, wind, is free.

Early days

When wind power was a few small wind turbines in a farmers field, connected to the local power grid, then a back up supply was not a significant issue as the power generated was very small. The key point in those early days was that the turbines themselves were uneconomic unless a subsidy was made to incentivise their installation. To justify this the vision was that they eventually could be made economic as they were undoubtedly a greener source of energy than some of the alternatives.

From a project perspective a highly entrepreneurial leadership approach was required as the industry was evolving very rapidly, turbines and wind farms were increasing in size dramatically, testing the boundaries in technology. manufacturing, transport, construction and operations. At this stage the investments were still largely made by wealthy individuals and developers. Another observation was that the level of wind power generated was less important than getting the permission to build the wind farm and obtaining a grid connection, if you had both of these then you were almost certain to generate a financial return because of the subsidy. The suppliers were also able to generate large returns in this market.

The bottom line here is the situation was unsustainable from the customer perspective as the cost of energy was going to rise to an uneconomic level. The industry and the ways of working had to change.

The industry matures

Now we get to a more typical project scenario where economics start to be in the ascendancy, the key requirements as the subsidies are stripped away are as follows:

- Location with permission for a wind farm

- Grid connection

- Sufficient wind (fuel) at the location to justify the investment

- Returns on investment for all parties, which includes supplier margins, are adequate

These are all interconnected with the wind available largely driving the investment potential, in essence high wind speeds are typically available in remote locations where to justify the building of the grid connection large scale is necessary. As the proposed wind farms are now so large their effect on the grid can be substantial; a back up supply now has to be available as well, some locations and countries have more opportunities than others in this respect as existing infrastructure may already be available such as CCGT (Combined Cycle Gas Turbine) and/or hydro plants.

Building the investment case

As a Project Leader the first steps are to put all the pieces together to see what will work, then to optimise it, this is all best done at the big picture level. For the investment to succeed the key requirements are:

- The capital investments generate the necessary revenue stream very quickly

- All parties get a return that is acceptable

- Ensure that the operations over the lifetime of the investments maintain the integrity of the revenue stream

It is important to note that the pricing of the energy provided by the wind farm will be set by the supplier to the consumer, this price will include some of the costs of the back up supply. Logically where there is already back up capability the price paid to the plant owner for wind energy will be different, probably higher, compared to the situation where more is required to be built. This is a very important factor when looking at the overall economics of wind.

Putting the key elements together

At a very simplistic level, assuming that there is planning permission, there are two key investments; the wind farm that generates the power and the grid to transfer that power to the consumer. To make the initial case viable the main levers are:

- Maximise the wind power generated, this is the revenue stream

- Ensure that the investments are turned into revenue as soon as possible

- Use a value based approach to the optimisation of the case

What this means is parallel execution, compressed schedules and a returns based assessment to assess how the available resources are used to best advantage to deliver value. To demonstrate why this is so important let’s run a very simple set of scenarios based on the three levers above.

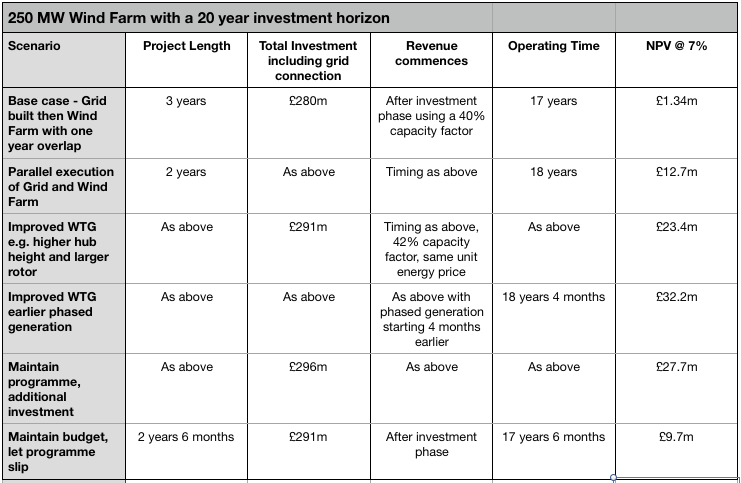

Investment case effects

A quick representative spreadsheet was used to highlight the effects, clearly there are a number of variables, particularly as you look into the future, however, any changes apply to all the options, consequently they will not affect the trends shown. The other important item to consider is that the scope of supply for all the cases are essentially the same for both the grid connection and the number of WTGs in the wind farm together with their associated infrastructure.

The table above shows that compressing timescales, getting to an earlier enhanced revenue improves the investment case markedly; as a Project Leader these are probably the two most important levers that you have in your armoury. The other outcome is that cutting or maintaining costs, without considering the effect on the programme, can frequently reduce the returns significantly. The paradox is that increasing project costs as an investment to cut execution timescales is well worth investigating as a way of improving returns.